Southern Maine life Fun Things to do NANCY TIMBERLAKE RE/MAX Shoreline The Common at 88 Middle Street Portland, Maine 04101; (207) 553-7314 ntimberlake@homesinmaine.com

Food, Entertainment, and Arts

Saturday, January 31, 2015

101 Things I Love about Portland Maine

Imperial China~~Tasty lunch specials including a variety of chicken dishes like Chicken with cashew nuts. Served with fresh tea, rice, and crisp noodles. http://imperialchinasouthportland.com/

Thursday, January 29, 2015

101 Things I Love about Portland Maine

O

Silly's Restaurant -- delicious fresh pizza with choice of toppings! Try a pitcher of their sangria to accompany the pizza and you've got a fantastic meal in funky fun surroundings. Friendly wait staff too.

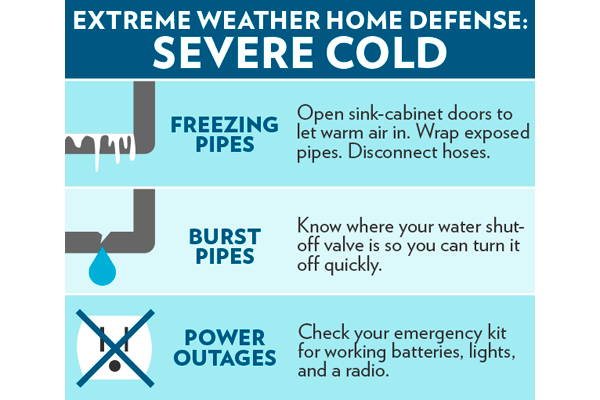

How to Protect Your Home From Severe Cold

How to Protect Your Home From Severe Cold

- By: Gwen Moran

The right tools and pre-winter maintenance will ensure that your home and your family are safe from cold-weather threats.

Image: HouseLogic

Image: HouseLogic

Homeowners in cold-weather climates, such as the Northeast, Midwest, and mountain areas, face icy conditions, blizzards, and other cold-weather storms. Beyond requiring a quick trip to the convenience store for milk and bread, snow, ice, freezing rain, and extreme cold can threaten your home’s structure and your safety. Therefore, it’s important to take measures and invest in the resources you’ll need to deal effectively with winter’s challenges before it gets into full swing.

Understand the Threats

Blizzards: Storms with heavy winds and large amounts of snow accumulation can cause roof or other structural damage and leave you isolated.

Ice storms and ice dams: Ice storms coat structures, trees, power lines, cars, roads — and virtually everything else — with ice. As the ice melts, large chunks can fall and cause injury to anyone below. When ice melts during the day and then re-freezes at night, ice dams, which block water from flowing in the gutter, may form. This condition can force water back under the roof line and cause leaks.

Related: How to Prevent Ice Dams

Sleet or freezing rain: Combinations of snow and freezing rain may cause slippery conditions and coat roads, sidewalks, and driveways with ice when temperatures drop.

Protect Yourself

The Federal Emergency Management Agency (FEMA) recommends that home owners have shovels on hand, as well as melting agents, such as rock salt. Some of the new, more environmentally friendly deicers include calcium magnesium acetate and sand to improve traction. Be sure to stock up early in the season, as these agents tend to be in short supply during periods before a well-publicized storm.

FEMA also advises you have enough fuel to maintain heat in your home, as well as a backup heating source: firewood if the home has a working fireplace, or a generator to power heaters in case of power failure. However, use caution as these can represent fire hazards when not used correctly. Be sure to follow directions explicitly and keep a fire extinguisher. Some generators and fireplaces also require proper ventilation, according to the Institute for Business and Home Safety, so follow directions carefully and keep them away from curtains or other flammable items.

Stock up on extra blankets, warm clothing, and enough food and water to sustain your family in case of a few days of isolation. And a transistor radio with fresh batteries can help keep you updated on news and information in case of a power outage.

Related: What Should Be in an Emergency Survival Kit?

Protect Your Home

Before winter, there are some precautions you can take to protect your home from the ravages of cold weather storms:

Winterize your home. Check shutters, siding, and other exterior materials to ensure they’re secure, says retired contractor and home improvement expert and writer John Wilder of Jacksonville, Fla. High winds, ice, and moisture from winter storms can easily strip off such outside elements if they’re loose.

Be sure that gutters are clear of debris and that walkways are even and don’t represent tripping hazards that can be exacerbated with snow or ice. Caulk drafty windows and apply weather stripping to doors — both inexpensive strategies that can keep heat in your home. Air sealing can help you save about $350 in energy costs or one-third of your average annual heating and cooling costs. The average annual home energy bill is about $2,200, according to Energy Star, of which about $1,000 represents heating and cooling. An assortment of air sealing materials and tools, including silicone foam, caulk, aluminum flashing for flues, and additional insulation, will run roughly $100 to $350.

Winterize pipes. Be sure your pipes, especially those exposed or in unheated areas like crawl spaces, are wrapped in insulation to prevent freezing and bursting. Also, learn where your water shut-off valves are so you can turn off the water supply in case of a leak. Six feet of insulation can cost anywhere from $7 to $17; it’s available at most home improvement stores.

Trim tree branches. Branches that overhang roofs or areas where you park your car — or which are simply overgrown — represent a risk to structures, vehicles, and people. Keep trees trimmed and remove those that are weak or sickly to prevent them from falling on or near your home. Tree trimming and removal pricing varies greatly, and you may have additional restrictions if you live in an historic community or if the trees are close to power lines.

Check with your municipality about any regulations and contact your local Chamber of Commerce, municipal offices, or contractor rating sites like MerchantCircle.com or AngiesList.com to get the names of reputable pros. Tree trimming and removal can be dangerous, so don’t attempt it on your own unless you’re experienced.

By keeping your home in good repair and stocking up on the supplies you’ll need before the rush for rock salt and shovels begins, you’ll be as ready as possible to tough out the storm.

Related: What’s the Best Way to Remove Snow?

Blizzards: Storms with heavy winds and large amounts of snow accumulation can cause roof or other structural damage and leave you isolated.

Ice storms and ice dams: Ice storms coat structures, trees, power lines, cars, roads — and virtually everything else — with ice. As the ice melts, large chunks can fall and cause injury to anyone below. When ice melts during the day and then re-freezes at night, ice dams, which block water from flowing in the gutter, may form. This condition can force water back under the roof line and cause leaks.

Related: How to Prevent Ice Dams

Sleet or freezing rain: Combinations of snow and freezing rain may cause slippery conditions and coat roads, sidewalks, and driveways with ice when temperatures drop.

Protect Yourself

The Federal Emergency Management Agency (FEMA) recommends that home owners have shovels on hand, as well as melting agents, such as rock salt. Some of the new, more environmentally friendly deicers include calcium magnesium acetate and sand to improve traction. Be sure to stock up early in the season, as these agents tend to be in short supply during periods before a well-publicized storm.

FEMA also advises you have enough fuel to maintain heat in your home, as well as a backup heating source: firewood if the home has a working fireplace, or a generator to power heaters in case of power failure. However, use caution as these can represent fire hazards when not used correctly. Be sure to follow directions explicitly and keep a fire extinguisher. Some generators and fireplaces also require proper ventilation, according to the Institute for Business and Home Safety, so follow directions carefully and keep them away from curtains or other flammable items.

Stock up on extra blankets, warm clothing, and enough food and water to sustain your family in case of a few days of isolation. And a transistor radio with fresh batteries can help keep you updated on news and information in case of a power outage.

Related: What Should Be in an Emergency Survival Kit?

Protect Your Home

Before winter, there are some precautions you can take to protect your home from the ravages of cold weather storms:

Winterize your home. Check shutters, siding, and other exterior materials to ensure they’re secure, says retired contractor and home improvement expert and writer John Wilder of Jacksonville, Fla. High winds, ice, and moisture from winter storms can easily strip off such outside elements if they’re loose.

Be sure that gutters are clear of debris and that walkways are even and don’t represent tripping hazards that can be exacerbated with snow or ice. Caulk drafty windows and apply weather stripping to doors — both inexpensive strategies that can keep heat in your home. Air sealing can help you save about $350 in energy costs or one-third of your average annual heating and cooling costs. The average annual home energy bill is about $2,200, according to Energy Star, of which about $1,000 represents heating and cooling. An assortment of air sealing materials and tools, including silicone foam, caulk, aluminum flashing for flues, and additional insulation, will run roughly $100 to $350.

Winterize pipes. Be sure your pipes, especially those exposed or in unheated areas like crawl spaces, are wrapped in insulation to prevent freezing and bursting. Also, learn where your water shut-off valves are so you can turn off the water supply in case of a leak. Six feet of insulation can cost anywhere from $7 to $17; it’s available at most home improvement stores.

Trim tree branches. Branches that overhang roofs or areas where you park your car — or which are simply overgrown — represent a risk to structures, vehicles, and people. Keep trees trimmed and remove those that are weak or sickly to prevent them from falling on or near your home. Tree trimming and removal pricing varies greatly, and you may have additional restrictions if you live in an historic community or if the trees are close to power lines.

Check with your municipality about any regulations and contact your local Chamber of Commerce, municipal offices, or contractor rating sites like MerchantCircle.com or AngiesList.com to get the names of reputable pros. Tree trimming and removal can be dangerous, so don’t attempt it on your own unless you’re experienced.

By keeping your home in good repair and stocking up on the supplies you’ll need before the rush for rock salt and shovels begins, you’ll be as ready as possible to tough out the storm.

Related: What’s the Best Way to Remove Snow?

Gwen Moran has written about finance and real estate for over a decade. Her work has been in Entrepreneur, Newsweek, and The Residential Specialist. A Jersey Shore resident, she’s weathered hurricanes, Nor’easters, and one earthquake.

Read more: http://www.houselogic.com/home-advice/seasonal-maintenance/protect-your-home-cold-weather-threats/#ixzz3QF8kitxt

Follow us: @HouseLogic on Twitter | HouseLogic on Facebook

Tuesday, January 20, 2015

Real Estate News

Natick, MA - January 20, 2015 - According to the RE/MAX of New England 2015 Housing Forecast, millennial buyers are expected to play a significant role in the 2015 housing market across the region, and New England will continue to experience inventory shortages in desirable areas, while consumers should expect to see higher interest rates in the second half of the year. RE/MAX of New England cites the convergence of increased consumer confidence, a rebounding local economy and continued low-interest rates to create a steady, consistent housing market throughout much of New England in 2014. Inventory shortages in desirable areas drove prices up, but throughout much of the region, overall home sales decreased over 2013 numbers. The first quarter of 2014 saw lower-than-anticipated sales throughout New England, but as interest rates and oil prices ticked down, and the weather heated up, pending sales throughout the region hit double-digit increases year-over-year. Price increases coupled with inventory shortages helped to motivate buyers from the sidelines resulting in a busy spring and summer market. Investors took a backseat in 2014, as fewer distressed or under-valued properties entered the market. According to the report, single-family and condominium home transactions were steady throughout New England in 2014, creating a very similar market to what was experienced in 2013. "Across New England we experienced extremely moderate price increases," said Dan Breault, Executive Vice President and Regional Director of RE/MAX of New England. "Single-family homes increased 0.8% on average, while condominiums fared better, rising 2.7% over last year's prices. This is the type of appreciation we expect to see in a healthy market and helps set the stage for what we can expect to see in 2015." To read the entire RE/MAX of New England 2015 Housing Forecast, click here. | |

|

Thursday, January 15, 2015

Buying Appliances

When is the Best Time to Buy Appliances?

A major appliance should never be an impulse buy. We pinpoint the best moments to buy, on and offline.

Most people know Black Friday is a good day for deals, but September, October, and January are some of the best months to buy. Image: Liz Foreman for HouseLogic

Most people know Black Friday is a good day for deals, but September, October, and January are some of the best months to buy. Image: Liz Foreman for HouseLogic

When it comes to landing bargains on major appliances, timing is everything. And the best time to buy home appliances is when stores need you more than you need a new home appliance.

Generally, that means you can get more value for your money:

Online Bargains

You can’t haggle with a website, so buying appliances online is more computer science than art of the deal. That’s where online data trackers, like Hukkster and TrackIf, can help you find the best time to get the best deals.

After crunching some numbers for us, TrackIf CEO Doug Berg pinpointed the very best times to buy appliances online:

More Appliance Buying Tips

In store, don’t be afraid to haggle over prices. The squeaky wheel often gets an additional discount, and it costs you nothing to say, “Is this the best price you can give me?”

When shopping online, compare prices using different browsers. An appliance deal viewed on Firefox could be priced differently when viewed on Safari.

Many stores offer additional discounts if you apply for their credit card. (But only apply if your credit score can handle another card.)

Sometimes appliance repair businesses stock slightly used or flawed — but deeply discounted — appliances. Check with your service guy before buying retail. (I bought a double oven this way and saved $700!)

If you can’t shop on sales days, you may discover the next time the store is going to lower prices by peeking into the metal price stand next to the appliance, which often is stuffed with cards stating the price and date of upcoming sales.

- September, October, and January when manufacturers roll out new home appliance models, and retailers are eager to move last year’s inventory. (Refrigerators are the exception. New models come out in the spring.)

- Last days of the month when stores are desperate to meet quotas and are more likely to dicker over prices.

- Thursday, the day before the weekend rush when aisles are less crowded.

- Major holidays — Labor Day, Memorial Day, President’s Day, Black Thursday (Friday, Saturday) — when stores take advantage of your day off and slash prices.

- Fall and winter are the best seasons to buy air conditioners and gas grills, because few buyers think about warm-weather appliances when leaves and snow cover the ground.

Online Bargains

You can’t haggle with a website, so buying appliances online is more computer science than art of the deal. That’s where online data trackers, like Hukkster and TrackIf, can help you find the best time to get the best deals.

After crunching some numbers for us, TrackIf CEO Doug Berg pinpointed the very best times to buy appliances online:

- November

- Thursdays (Retailers are twice as likely to reduce prices on Thursdays.)

- The 4th or 5th of the month (when people get their paychecks), and the 23rd to 29th of the month (quota desperation).

- 3 p.m.

More Appliance Buying Tips

In store, don’t be afraid to haggle over prices. The squeaky wheel often gets an additional discount, and it costs you nothing to say, “Is this the best price you can give me?”

When shopping online, compare prices using different browsers. An appliance deal viewed on Firefox could be priced differently when viewed on Safari.

Many stores offer additional discounts if you apply for their credit card. (But only apply if your credit score can handle another card.)

Sometimes appliance repair businesses stock slightly used or flawed — but deeply discounted — appliances. Check with your service guy before buying retail. (I bought a double oven this way and saved $700!)

If you can’t shop on sales days, you may discover the next time the store is going to lower prices by peeking into the metal price stand next to the appliance, which often is stuffed with cards stating the price and date of upcoming sales.

Read more: http://www.houselogic.com/home-advice/appliances/when-is-the-best-time-to-buy-appliances/#ixzz3OuCRFPIi

Follow us: @HouseLogic on Twitter | HouseLogic on Facebook

Wednesday, January 14, 2015

Moving Up

Feeling a Little Cramped? Moving Up

If your home is giving you "the squeeze" because your family has grown or you're seriously thinking about buying a home in a more upscale neighborhood, then you may be ready to move up to your next home. But how do you get started?

Begin with a "reality check."

Take some time to really look at what the next step may be. Visit the neighborhoods you may be interested in. Tour open houses or homes for sale to see what kind of home is available in your price range. I can show you neighborhoods and homes that you might not have considered, but that will meet your needs. Trust your instincts and focus on what you know fits your lifestyle. Then I can help advise you on the value and investment quality of the homes on the market.

Next, talk to your lender to see what kinds of mortgage programs and rates are available, as well as how much you will qualify for. More important, take a hard look at your household budget to realistically determine how much of a mortgage payment you can afford each month. If you don't already have a good relationship with a lender, I'd be happy to refer you to lenders who offer mortgage programs that meet your needs.

In the meantime, I can perform a Comparative Market Analysis (CMA) for your current home to see how it compares to other homes sold in your neighborhood. Then we can determine a realistic asking price. I can also recommend ways to prepare your home for sale. Once you have made a realistic assessment of what you're getting into, then we can put your house on the market and begin to seriously look for your next home.

What if you find a home before yours sells…or vice versa

One of the biggest concerns of move-up buyers is what happens if they find their dream home before their current one sells, or if their home sells before they find a new one. Here's a brief look at several options (please call me for greater detail or help with your particular situation):

If you have an acceptable offer for your home on the table but haven't yet found a new house to move to, you can:

Go for it with the understanding that you may have to move twice - once to a short-time rental unit, the second time to your new home.Accept the offer with the stipulation that you want a long closing and the right to rent back from the new owner for 60, 90 or 120 days. Assure the buyer that you will do everything possible to move things along so they may be able to take possession of the home sooner than the specified terms.Inform the buyer you'll sell the home only if you can find a house you like and it will take 30 to 60 days to determine if, indeed, you will sell. This may seem a bit risky but this approach can be successful if you allow the buyer to do their inspection (not appraisal) and get their financing in order while you shop for a new home. You also allow them to continue looking at other homes on the market. If the buyer finds something they like better, then you agree to let them out of the deal and refund their inspection cost (typically it's only $200-$300). This a good way to avoid having to take your home off the market while you're looking, only to have the buyer then do an inspection after you've found a new home, giving them an opportunity to renegotiate the deal when they know you're over a barrel. To prevent surprises at the outset, we can include in your listing description a phrase such as "...the sale of this house is contingent on the seller finding a suitable home..."

Think about the future

When looking for your new home, try to think more about your future needs than your current needs. Generally, I recommend buying as much home as you can afford without overextending yourself, especially if you're buying a new home with few maintenance issues. By stretching a bit within your personal budget, the home will better meet your current and future lifestyle, you will likely hang on to it longer, and it will be a better-performing investment in the long run.

With all that said, remember that you will likely not live in your new home forever. According to U-Haul, the average American relocates 11 times over the course of his or her life (Ladies Home Journal, July 1998). If your new home meets many of your needs, then go for it. You likely will be moving up again in the future.

FHA News

|

TIMBER--great Happy Hour wine special--all glasses $5

Try an $18 glass of fine wine for $5!

Also, Monday and Tuesday--fantastic burgers--second for half price!http://timberportland.com/

Simple Home Repairs

12 Simple Home Repair Jobs to Lift You Out of Winter’s Funk

- By: Jeanne Huber

Winter’s doldrums got you down? Grab a screwdriver and a hammer and fight back with easy home repairs that’ll raise spirits and get your house ready for spring.

Squeaky wood floors? Quiet creaks by dusting talcum powder into the seam between the floorboards. Image: Libby Walker for HouseLogic

Squeaky wood floors? Quiet creaks by dusting talcum powder into the seam between the floorboards. Image: Libby Walker for HouseLogicAccomplishments — even little ones — go a long way toward a sunny outlook. Fortunately, there are plenty of easy, quick home repair chores you can do when you’re mired in the thick of winter. For max efficiency, make a to-do list ahead of time and shop for all the tools and supplies in one trip. On your work days, put the basics in a caddy and carry it from room to room, checking off completed tasks as you speed through them.

What to Look (and Listen) For

In each room, look around and take stock of what needs fixing or improving. Focus on small, quick-hit changes, not major redos. Here are some likely suspects:

1. Sagging towel rack or wobbly toilet tissue holder. Unscrew the fixture and look for the culprit. It’s probably a wimpy, push-in type plastic drywall anchor. Pull that out (or just poke it through the wall) and replace it with something more substantial. Toggle bolts are strongest, and threaded types such as E-Z Ancor are easy to install.

2. Squeaky door hinges. Eliminate squeaks by squirting a puff of powdered graphite ($2.50 for a 3-gram tube) alongside the pin where the hinge turns. If the door sticks, plane off a bit of the wood, then touch up the paint so the surgery isn’t noticeable.

3. Creaky floor boards. They’ll shush if you fasten them down better. Anti-squeak repair kits, such as Squeeeeek No More ($23), feature specially designed screws that are easy to conceal. A low-cost alternative: Dust a little talcum powder into the seam where floorboards meet — the talcum acts as a lubricant to quiet boards that rub against each other.

4. Rusty shutoff valves. Check under sinks and behind toilets for the shutoff valves on your water supply lines. These little-used valves may slowly rust in place over time, and might not work when you need them most. Keep them operating by putting a little machine oil or WD-40 on the handle shafts. Twist the handles back and forth to work the oil into the threads. If they won’t budge, give the oil a couple of hours to penetrate, and try again.

5. Blistered paint on shower ceilings. This area gets a lot of heat and moisture that stresses paint finishes. Scrape off old paint and recoat, using a high-quality exterior-grade paint. Also, be sure everyone uses the bathroom vent when showering to help get rid of excess moisture.

6. Loose handles or hinges on furniture, cabinets, and doors. You can probably fix these with a few quick turns of a screwdriver. But if a screw just spins in place, try making the hole fit the screw better by stuffing in a toothpick coated with glue, or switching to a larger screw.

Safety Items

You know those routine safety checks you keep meaning to do but never have the time? Now’s the time.

7. Carbon monoxide and smoke detectors. If you don’t like waking up to the annoying chirp of smoke detector batteries as they wear down, do what many fire departments recommend and simply replace all of them at the same time once a year.

8. Ground-fault circuit interrupter (GFCI) outlets. You’re supposed to test them once a month, but who does? Now’s a great time. You’ll find them around potentially wet areas — building codes specify GFCI outlets in bathrooms, kitchens, and for outdoor receptacles. Make sure the device trips and resets correctly. If you find a faulty outlet, replace it or get an electrician to do it for $75 to $100.

Another good project is to replace your GFCIs with the latest generation of protected outlets that test themselves, such as Levitron’s SmartlockPro Self-Test GFCI ($28). You won’t have to manually test ever again!

9. Exhaust filter for the kitchen stove. By washing it to remove grease, you’ll increase the efficiency of your exhaust vent; plus, if a kitchen stovetop fire breaks out, this will help keep the flames from spreading.

10. Clothes dryer vent. Pull the dryer out from the wall, disconnect the vent pipe, and vacuum lint out of the pipe and the place where it connects to the machine. Also, wipe lint off your exterior dryer vent so the flap opens and closes easily. (You’ll need to go outside for that, but it’s quick.) Remember that vents clogged with old dryer lint are a leading cause of house fires.

11. Drain hoses. Inspect your clothes washer, dishwasher, and icemaker. If you see any cracks or drips, replace the hose so you don’t come home to a flood one day.

12. Electrical cords. Replace any that are brittle, cracked, or have damaged plugs. If you’re using extension cords, see if you can eliminate them — for example, by replacing that too-short lamp cord with one that’s longer. If you don’t feel up to rewiring the lamp yourself, drop it off at a repair shop as you head out to shop for your repair materials. It might not be ready by the end of the day. But, hey, one half-done repair that you can’t check off is no big deal, right?

In each room, look around and take stock of what needs fixing or improving. Focus on small, quick-hit changes, not major redos. Here are some likely suspects:

1. Sagging towel rack or wobbly toilet tissue holder. Unscrew the fixture and look for the culprit. It’s probably a wimpy, push-in type plastic drywall anchor. Pull that out (or just poke it through the wall) and replace it with something more substantial. Toggle bolts are strongest, and threaded types such as E-Z Ancor are easy to install.

2. Squeaky door hinges. Eliminate squeaks by squirting a puff of powdered graphite ($2.50 for a 3-gram tube) alongside the pin where the hinge turns. If the door sticks, plane off a bit of the wood, then touch up the paint so the surgery isn’t noticeable.

3. Creaky floor boards. They’ll shush if you fasten them down better. Anti-squeak repair kits, such as Squeeeeek No More ($23), feature specially designed screws that are easy to conceal. A low-cost alternative: Dust a little talcum powder into the seam where floorboards meet — the talcum acts as a lubricant to quiet boards that rub against each other.

4. Rusty shutoff valves. Check under sinks and behind toilets for the shutoff valves on your water supply lines. These little-used valves may slowly rust in place over time, and might not work when you need them most. Keep them operating by putting a little machine oil or WD-40 on the handle shafts. Twist the handles back and forth to work the oil into the threads. If they won’t budge, give the oil a couple of hours to penetrate, and try again.

5. Blistered paint on shower ceilings. This area gets a lot of heat and moisture that stresses paint finishes. Scrape off old paint and recoat, using a high-quality exterior-grade paint. Also, be sure everyone uses the bathroom vent when showering to help get rid of excess moisture.

6. Loose handles or hinges on furniture, cabinets, and doors. You can probably fix these with a few quick turns of a screwdriver. But if a screw just spins in place, try making the hole fit the screw better by stuffing in a toothpick coated with glue, or switching to a larger screw.

Safety Items

You know those routine safety checks you keep meaning to do but never have the time? Now’s the time.

7. Carbon monoxide and smoke detectors. If you don’t like waking up to the annoying chirp of smoke detector batteries as they wear down, do what many fire departments recommend and simply replace all of them at the same time once a year.

8. Ground-fault circuit interrupter (GFCI) outlets. You’re supposed to test them once a month, but who does? Now’s a great time. You’ll find them around potentially wet areas — building codes specify GFCI outlets in bathrooms, kitchens, and for outdoor receptacles. Make sure the device trips and resets correctly. If you find a faulty outlet, replace it or get an electrician to do it for $75 to $100.

Another good project is to replace your GFCIs with the latest generation of protected outlets that test themselves, such as Levitron’s SmartlockPro Self-Test GFCI ($28). You won’t have to manually test ever again!

9. Exhaust filter for the kitchen stove. By washing it to remove grease, you’ll increase the efficiency of your exhaust vent; plus, if a kitchen stovetop fire breaks out, this will help keep the flames from spreading.

10. Clothes dryer vent. Pull the dryer out from the wall, disconnect the vent pipe, and vacuum lint out of the pipe and the place where it connects to the machine. Also, wipe lint off your exterior dryer vent so the flap opens and closes easily. (You’ll need to go outside for that, but it’s quick.) Remember that vents clogged with old dryer lint are a leading cause of house fires.

11. Drain hoses. Inspect your clothes washer, dishwasher, and icemaker. If you see any cracks or drips, replace the hose so you don’t come home to a flood one day.

12. Electrical cords. Replace any that are brittle, cracked, or have damaged plugs. If you’re using extension cords, see if you can eliminate them — for example, by replacing that too-short lamp cord with one that’s longer. If you don’t feel up to rewiring the lamp yourself, drop it off at a repair shop as you head out to shop for your repair materials. It might not be ready by the end of the day. But, hey, one half-done repair that you can’t check off is no big deal, right?

Jeanne Huber is the author of 10 books about home improvement. She writes a weekly column about home care for the Washington Post.

Read more: http://www.houselogic.com/home-advice/repair-tips/home-repair-jobs-winter/#ixzz3OnyHACBN

Follow us: @HouseLogic on Twitter | HouseLogic on Facebook

Friday, January 2, 2015

101 Things I Love about Portland Maine

The Cockeyed Gull on Peaks Island: Fab views of Portland. Grab a glass of wine while you wait for your ferry.

Subscribe to:

Posts (Atom)